Monica Greer holds a PhD in economics, a Master’s in economics, and a Bachelor’s in finance. She is currently a senior quantitative analyst and has published two books on cost modeling. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice.

Create a Free Account and Ask Any Financial Question

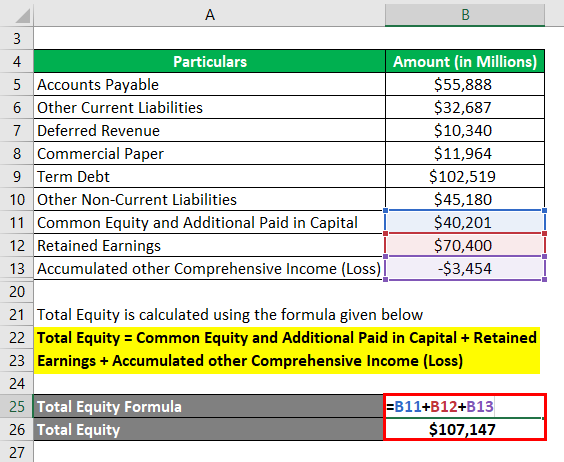

Yes, the ratio doesn’t consider the quality of debt or equity, such as interest rates or equity dilution terms. But, what would happen if the company changes something on its balance sheet? Let’s look at two examples, one in which the company adds debt and one in which the company adds equity to the balance sheet. 11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements.

Salary & Income Tax Calculators

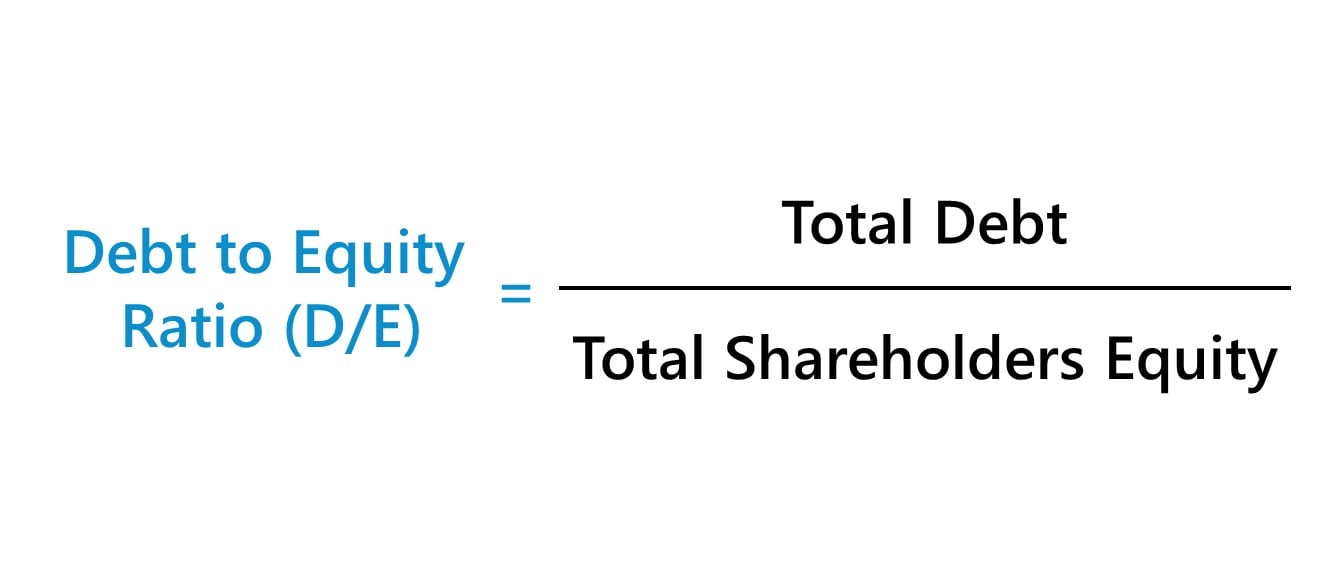

- But if you want to know the exact formula for calculating debt to equity ratio then please check out the “Formula” box above.

- In addition to interest, there are other costs like origination fees and closing costs, ranging from 2% to 5% of the loan amount.

- When a company is borrowing lesser debt than the funding provided by the shareholders, it will represent a lower debt to equity ratio.

You can calculate the D/E ratio of any publicly traded company by using just two numbers, which are located on the business’s 10-K filing. However, it’s important to look at the larger picture to understand what this number means for the business. On the other hand, a comparatively low D/E ratio may indicate that the company is not taking full advantage of the growth that can be accessed via debt. Liabilities are items or money the company owes, such as mortgages, loans, etc. Investors may check it quarterly in line with financial reporting, while business owners might track it more regularly. But, if debt gets too high, then the interest payments can be a severe burden on a company’s bottom line.

Loan Calculators

The personal D/E ratio is often used when an individual or a small business is applying for a loan. Lenders use the D/E figure to assess a loan applicant’s ability to continue making loan payments in the event of a temporary loss of income. Business owners use a variety of software to track D/E ratios and other financial metrics. Microsoft Excel provides a balance sheet template that automatically calculates financial ratios such as the D/E ratio and the debt ratio.

The companies that invest huge amounts of money in operations and assets have a higher debt to equity ratio. For the investors and lenders, this high ratio will point towards investment with greater risks because the business might not be able to generate enough revenues to pay back the debts. The debt to equity ratio calculator provides insight and understanding of the financial status of a company. When you decide to invest in a company, a higher debt to equity ratio means that the investment could be riskier. Thus emerges, the need for a calculator, which helps in understanding where and when to invest. If the ratio is greater than 50%, then it is always recommended to reconsider investing to make sure there are no liquidity issues.

Take bookkeeping off your plate, for good.

Although a high debt to equity ratio may seem alarming at first glance, it is not always so. Moreover, it could also indicate that the business has the leverage to give returns to its shareholders. This is because it represents the leverage of the company and indicates its stability. The concept of a “good” D/E ratio is subjective irs still working on last year’s tax returns may extend 2021 tax deadline and can vary significantly from one industry to another. Therefore, it is essential to align the ratio with the industry averages and the company’s financial strategy. The D/E ratio includes all liabilities except for a company’s current operating liabilities, such as accounts payable, deferred revenue, and accrued liabilities.

Companies with a high D/E ratio can generate more earnings and grow faster than they would without this additional source of funds. However, if the cost of debt interest on financing turns out to be higher than the returns, the situation can become unstable and lead, in extreme cases, to bankruptcy. The D/E ratio illustrates the proportion between debt and equity in a given company.

However, using this formula for the long-term is not right as the payment of debt also needs to be included while calculating this ratio. Moreover, it represents the shareholders’ ability to repay any debts if the business were to hit a bumpy stretch. You may, however, want to note that the debt to equity ratio varies across industries. The debt-to-equity ratio is a way to assess risk when evaluating a company. The ratio looks at debt in relation to equity, providing insights into how much debt a company is using to finance its operations.

For example, Company A has quick assets of $20,000 and current liabilities of $18,000. Company B has quick assets of $17,000 and current liabilities of $22,000. Utilities and financial services typically have the highest D/E ratios, while service industries have the lowest. A lower D/E ratio suggests the opposite – that the company is using less debt and is funded more by shareholder equity. However, if the company were to use debt financing, it could take out a loan for $1,000 at an interest rate of 5%. Debt financing is often seen as less risky than equity financing because the company does not have to give up any ownership stake.

Leave A Comment