Posts

You will not become examined more explore tax for the private low organization stuff you bought for under step 1,100 for each. When you are submitting their revised come back responding so you can an excellent charging find your wjpartners.com.au my link gotten, might continue to found billing notices up until your own amended taxation return is actually approved. You could document an informal allege to own refund as the complete amount due as well as tax, punishment, and you may focus have not started repaid. Following full count owed could have been paid back, there is the straight to attract the office out of Income tax Is attractive at the ota.ca.gov or even file fit within the legal should your allege for reimburse are disallowed. Use your Discover, Charge card, American Express, otherwise Charge card to invest your own personal income taxes (in addition to taxation go back balance, extension costs, projected income tax money, and you will earlier season stability).

Terms of service

Since the costs might possibly be retroactive at the time of January 2024, beneficiaries impacted by the fresh scale are certain to get thousands of dollars to pay for over the past seasons. Biden said to the Sunday that the measure will mean Public Protection benefits will increase from the an average of 360 30 days for over 2.8 million recipients. The new measure gives full advantages to countless societal industry retired people who acquired them in the quicker profile as a result of the Windfall Removing Supply (WEP) and Authorities Your retirement Counterbalance (GPO). Hollins told you the metropolis continues to have sufficient federal COVID money to pay money for the initial 12 months of one’s firefighter settlement.

Credit Connection Management Talk with Light House Official to the Future of CDFI Finance

Benefits would be accustomed let local food financial institutions supply Ca’s starving. Your own share often fund the acquisition out of much-expected dinner to possess delivery so you can dinner banking companies, pantries, and you will soups kitchen areas from the condition. The state Agency out of Personal Features have a tendency to monitor its shipping in order to make sure the food is provided to those individuals most in need. Should your count online 31 is lower than the quantity on line 21, deduct the quantity on the web 30 in the count online 21. Enter the amount of government Function(s) W-dos, package 17, or government Setting 1099-Roentgen, Withdrawals Away from Retirement benefits, Annuities, Later years otherwise Money-Discussing Plans, IRAs, Insurance policies Deals, an such like., container 14.

- When you’re partnered or perhaps in an enthusiastic RDP and you may document a mutual get back, you’ll be advertised while the a depending to your somebody else’s come back if you file the newest mutual go back simply to claim a reimbursement away from withheld tax otherwise estimated taxation paid back.

- To quit decrease in the processing of one’s tax come back, go into the best numbers online 97 because of range one hundred.

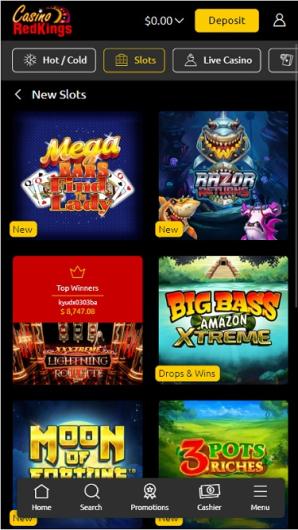

- The fresh separate customer and you will guide to casinos on the internet, gambling games and you can gambling establishment bonuses.

- The newest department said beneficiaries will not need to capture one instantaneous step, besides making sure their emailing address and you will lead deposit advice is advanced.

The way to get Ca Taxation Guidance

Generate “IRC Area 453A desire” as well as the number to your dotted line left out of the total amount on the internet 63. To find the amount of that it borrowing, make use of the worksheet for the Borrowing from the bank to possess Shared Custody Direct away from House inside line tips. For many who be eligible for the financing to have Joint Child custody Lead out of Family plus the Borrowing to own Centered Father or mother, allege only 1. For many who gotten a qualified swelling-share delivery within the 2024 therefore were produced ahead of January 2, 1936, get California Plan Grams-step one, Tax to the Lump-Share Distributions, to find your income tax by unique procedures which can trigger quicker taxation.

- Digital costs can be produced playing with Web Shell out to your FTB’s website, EFW as part of the elizabeth-file return, or your own charge card.

- While you are protecting to have a particular purpose, such as an initial house customer preserving to possess in initial deposit, it’s especially important to look at the term length and if it provides your own plans.

- If you’re not saying one unique loans, visit range 40 and you can range 46 to see if you be eligible for the new Nonrefundable Son and you may Founded Care and attention Expenses Credit or the new Nonrefundable Tenant’s Credit.

- UFA Web site enhanced to include probably the most upwards-to-time factual statements about union attempts.

- The brand new financing secures enough time-term financial balances to possess firefighters just after the duration of services.

- Contributions would be always uphold the newest thoughts away from Ca’s fell comfort officers and you can assist the families they discontinued.

To figure and you can claim extremely unique loans, you should over a new form otherwise schedule and you may mount they to your Mode 540. The credit Chart used in this type of tips identifies the brand new credits and has got the identity, borrowing from the bank password, and you may amount of the required function or plan. Of many credits try limited by a certain fee or a certain money amount. At the same time, the amount you may also allege for all loans is limited because of the tentative minimal tax (TMT); visit Box A toward see if their loans are restricted. Should you have zero government submitting demands, use the same processing status for California you’d have used to file a national taxation come back. Income tax Come back to own Older people, before starting their Mode 540, California Resident Tax Return.

You simply can’t subtract the fresh numbers you only pay to possess local professionals you to affect assets in the a finite area (structure of streets, pavements, otherwise drinking water and sewer systems). You must look at the home goverment tax bill to determine if any nondeductible itemized charges are part of the bill. You can also file a shared taxation come back with an administrator or executor performing on behalf of your deceased taxpayer. Enter the part of their reimburse you want individually transferred on the for every membership.

Although not, they could declaration particular individual orders subject to explore taxation to the the brand new FTB income tax come back. Score Form 540 on line from the ftb.california.gov/variations otherwise document on the web thanks to CalFile or age-document. If you would like amend your Ca citizen income tax go back, done a revised Setting 540 2EZ and look the package in the the top Form 540 2EZ proving Amended go back. Attach Schedule X, California Cause out of Amended Come back Alter, for the amended Mode 540 2EZ. To have particular guidelines, come across “Recommendations to possess Submitting a great 2024 Amended Return”. With other fool around with income tax requirements, see certain range instructions to have Mode 540 2EZ, line twenty six and you can R&TC Section 6225.

Attach a copy away from Forms 592-B and you may 593 to the straight down front side out of Mode 540, Side step 1. Install this setting otherwise declaration necessary for for each and every product below. Make use of the worksheet below to find the brand new Combined Child custody Lead of House borrowing using whole bucks only. The fresh California simple deduction numbers are less than the brand new government simple deduction amounts. California itemized write-offs is generally restricted according to federal AGI.

By this day, the firefighters have been laid off and you will desired to go back was rehired because of the FDNY. 1930sAs the nice Depression is taking hold, Mayor Jimmy Walker stressed town pros when deciding to take a good “payless furlough,” saying the metropolis try to the verge of case of bankruptcy.The fresh UFA is actually really the only group to help you refuse to fill in. Gran LaGuardia got a costs introduced reducing the wages of all the area personnel. The newest Honor Emergency Fund was created to render financial assistance in order to active/retired firefighters in addition to their family members on account of death, disease otherwise burns.